Thursday, September 1, 2011

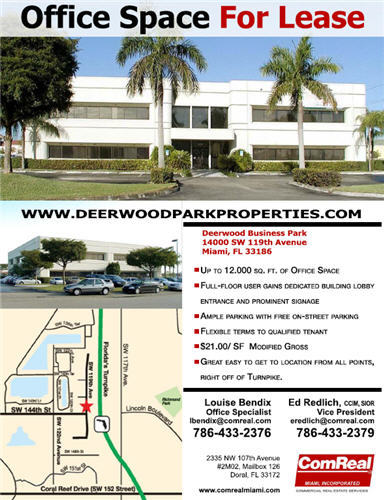

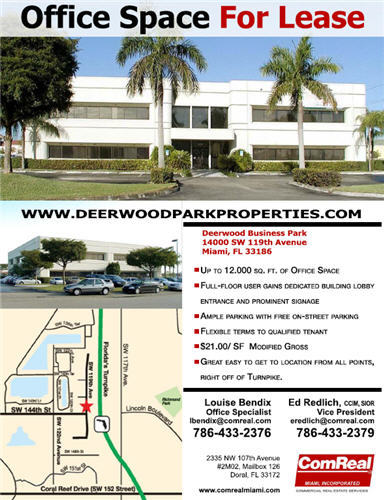

Great 12,000 SF full-floor office opportunity with signage, ample parking, and designated entrance.

Thursday, September 2, 2010

Some facts revealed:

• Energy consumption in commercial office buildings exceeds transportation.

• Since energy costs are such a significant part of operating costs, reductions in usage has a recognizable impact on NOI.

• Energy consumption measurements are becoming a bigger factor in determining building values in California.

• The School District of Palm Beach County built the first LEED Gold-certified K-12 school in Florida. Pine Jog Elementary now serves as an efficiency model in the county's facility management decisions because of its measurable success.

• Incorporating green management practices is becoming more the norm since sustainability applies to environment and economics.

• Educating tenants and end users is key to a successful sustainability plan.

LOUISE BENDIX,LEED-AP | Office Leasing Speicalist

ComReal Miami, Inc.|Commercial Real Estate Services

366 Altara Ave., Suite 102 | Coral Gables, FL 33146

T 786-433-2376 | F 888-316-6818 |Join my Network

lbendix@comreal.com

Saturday, August 7, 2010

ComReal Miami and the Miami Association of Realtors

ComReal Miami commercial real estate services is proud to be members of the newly-named Miami Association of Realtors (MAR). MAR is now the largest Realtor organization in the world with over 23,000 Realtors. The former REALTOR Association of Greater Miami and the Beaches (RAMB) and the REALTOR Association of Miami-Dade County (RAMDC) have merged to become the Miami Association of Realtors (MAR). Visit their website at www.Miamire.com.

In other news, Ed Redlich, Vice-President of ComReal Miami, was named as Director for the Miami Realtor Commercial Alliance (RCA) along with his fellow Miami commercial real estate brokers.

For more information on The ComReal Companies, please visit www.comrealmiami.com or call 305-591-3044.

Tuesday, September 8, 2009

ABMC Loans: Miami Commercial Real Estate Mortgage Broker

If you like to do business the old fashioned way with a personal touch from competent professionals, please consider contacting ABMC American Bankers Mortgage Corp. Based in Coral Gables on Almeria Avenue, Eric Garcia and Manny Ojeda specialize in financing Miami commercial real estate properties for owner-users and SBA loans. Call them now at 305-448-6446 or visit their website at www.abmcloans.com to learn more about Miami commercial real estate mortgage brokers.

If you like to do business the old fashioned way with a personal touch from competent professionals, please consider contacting ABMC American Bankers Mortgage Corp. Based in Coral Gables on Almeria Avenue, Eric Garcia and Manny Ojeda specialize in financing Miami commercial real estate properties for owner-users and SBA loans. Call them now at 305-448-6446 or visit their website at www.abmcloans.com to learn more about Miami commercial real estate mortgage brokers.

Saturday, September 5, 2009

BIS Commercial Real Estate Property Inspections

Friday, August 28, 2009

Edward Redlich's NEW website

I am pleased to inform you about the launch of my new website for Miami commercial real estate now at www.EdwardRedlich.com. As you know, I’ve specialized in the Miami industrial warehouse business with The ComReal Companies for over 15 years.

Please let me know if you or someone you know needs assistance. Rest assured, you will receive my Team’s best, personal efforts. Thank you very much. -Edward Redlich

Friday, July 10, 2009

CIASF: America’s Anti-Trade Policies

CIASF Luncheon Event

Topic: “America’s Anti-Trade Policies”

Sponsor: The ComReal Companies in Miami

Date: July 10th , 2009

Location: Flagler Station Business Park in Medley, FL

Good afternoon everyone! My name is Edward Redlich and I’m with The ComReal Companies of Miami. This year, The ComReal Companies celebrate its 30th year in South Florida’s commercial real estate market. ComReal continues to be a proud sponsor of this organization. Although we have invested in a few minutes to speak today about our company, I’d much rather allot my time to introduce a gentleman who is going to educate us on a much more important topic. The topic is “America’s anti-trade policies”. Mr. Neal Asbury is both an excellent communicator on the subject and a true visionary. Personally, I believe that he just might be the “Missing Link” between those of us in the commercial real estate profession and the customers that we serve.

Before I give you the background on Mr. Asbury, allow me just a moment to tell you why ComReal and I support the Miami CIASF organization. We do it to promote the commercial real estate industry and for the knowledge. Today, our South Florida industrial real estate market has experienced three quarters of extremely low deal volume. Rental rates and sales prices have fallen between 20% and 40%; or even more. Vacancy is over 10%. We fear the negative trend may continue. However, our industry can flourish once again with the right stimulus. In my opinion, one solution is for America to aggressively promote the liberalization of international free trade. As international trade increases, so does the activity for industrial real estate properties. Perhaps there is no other area of the country where international trade is more important to the CRE industry than right here in South Florida.

Now, let me tell you how I came across Mr. Asbury. Not only am I a deal junkie, but I’m also a news junkie. I discovered Mr. Asbury over a year ago while surfing the internet I came across his blog at www.asburysworld.com.

I was instantly impressed by the over 100 articles that he has published on global trade issues. He has also been quoted in newspapers such New York Times and the Wall Street Journal. Mr. Asbury has addressed the United Nations, various universities and numerous trade associations; such as ours today. In addition, he hosts The Neal Asbury Show from Coral Gables which airs live on Fridays from 5 to 6 PM on the radio at 880 AM. The station is affiliated with Bloomberg Radio and CNBC. In just a few hours from now, he will be interviewing US Ambassador John Negroponte. So be sure to tune in this afternoon and you may also grab his flyers on the front desk to learn more.

Not only is Mr. Asbury an expert commentator on the subjects of international trade and manufacturing, but he actually operates his own companies: Legacy Brands and Greenfield World Trade which manufacturers, sells and services American-made products to over 130 countries worldwide. So, when you hear him speak in a moment, please understand that he is not a politician, but a true American entrepreneur.

Before Greenfield World Trade he had founded Asbury WorldWide in 1987 which became the largest American export management company in its segment with twelve distribution centers around the globe. In 1989, he began FAB Asia in the Philippines which was the Asian exclusive fabricator of commercial kitchens for McDonalds and other restaurant chains. For all of his efforts, he has earned several industry awards. He is chairman of the South Florida District Export Council, appointed to serve by the U.S. Secretary of Commerce. He is a member of the International Advisory Committee to the Governor of Florida and a member of the prestigious International Policy Committee of the U.S. Chamber of Commerce in Washington.

Now, when my father got me into this business 15 years ago, he always told me, “Ed, when you want to get something done, give it to someone who is busy”. Neal, I do not where you find the time to get all of these things done, but we sure do appreciate your taking the time from your busy schedule to address our group. Thank you very much. Please welcome Neal Asbury….

Ed Redlich and Neal Asbury

Ed Redlich and Neal AsburyContact: Edward Redlich of ComReal Miami. 786-433-2379 or visit www.edwardredlich.com

Friday, July 3, 2009

Letter to the NAR Opposing H.R. 2454

ATTN: National Association of Realtors

c/o Mr. Austin Perez

via email

Dear Mr. Perez,

As a Realtor, I appreciate all of the NAR's efforts in advocating the real estate industry. I'm actually involved in several Realtor organizations including RCA, SIOR and CCIM. I write you today in regards to the American Clean Energy and Security Act, H.R. 2454, that was passed by the House of Representatives on June 26th. The National Association of Realtors has made some positive changes to this bill especially from the residential perspective. Please keep up the good work. However, if this legislation is passed into law, it would be absolutely disastrous to the commercial real estate industry.

For the past 15 years, I have specialized in Miami's industrial real estate market. My customers are in manufacturing, trucking, distribution, international importing & exporting, etc. Many are struggling as it is right now and some work only four of five days a week to keep operating expenses down. This Act would increase energy expenses to the extreme extent of disabling these industries indefinitely. If their business suffers, the commercial real estate market suffers. The lower the demand for warehouse space, the worse it will be for us commercial Realtors.

In President Obama's own words "Under my plan of a cap and trade system, electricity rates would necessarily skyrocket." In my opinion, our collective industries cannot bear the burden of these increased transportation, fuel and electrical costs in addition to the new taxes from this Act. The higher energy costs and regulations will make Americans less competitive in the global market and jobs will be lost, not gained.

I encourage the NAR to oppose HR 2454 and any other legislation that imposes higher taxation and costs onto American industries. Let's work to promote the liberalization of energy policies which includes lower taxation and energy costs.

Thank you very much for your consideration.

Edward J. Redlich, SIOR, CCIM Vice President

ComReal Miami, Inc. Commercial Real Estate Services

8725 NW 18th Terrace, Suite 105 Miami, FL 33172

Monday, June 1, 2009

Miami Property Tax Assessments Reduced

Pedro Garcia, Miami-Dade County's Property Appraiser, announced today that property taxes have fallen 12.1% for the year 2009. Expect your notice in the month of August. Hopefully, this will mean that our property taxes are reduced as well on all Miami commercial real estate properties.

A 17,000 sq. ft. warehouse building I sold recently had a property tax bill of about $38,000 (or about $2.24 per square foot). Its fairly difficult for a company to pay these heavy burdens in addition to all the other taxes on commercial businesses.

Mr. Garcia was our guest speaker at CCIM Miami's April luncheon. We look forward to having him back in 2010.

Sunday, May 31, 2009

ComReal Companies Celebrate 30 Years in the Commercial Real Estate Industry

Thank you !!!

On May 31st, 2009, The ComReal Companies celebrate its 30th Anniversary. Over the years, ComReal has played an integral role in the commercial development of South Florida.

In 1979, the Stephen H. Smith Company was founded. The name was later changed to ComReal. Mr. Smith, Founder and President, was considered a pioneer for locating the office in Miami’s Airport West market. He helped develop Americas’ Gateway Park, an 136-acres business park which was one of the first of its kind in South Florida. Today, the ComReal Team continues to lead the commercial real estate profession.

“ComReal has been a great fit for me.” states Ed Redlich, Vice-President. “For all of my 15 years in this career, ComReal has encouraged me to grow, develop and learn. Everyone adapts the tools & technology and then specializes in a certain product to become an expert. We also each get involved and take a leadership role in professional organizations.” Redlich is a second generation associate. His father, Ronald, was also an industrial specialist with ComReal and helped mentor his son into the business. Redlich currently has the leasing assignment for a 240,000 sq. ft. warehouse development within Homestead Park of Commerce and for over 500,000 sq. ft. of warehouse space for The Faith Family. This include Beacon at 97th ; a Class A business park in Doral.

“For Over 30 Years, ComReal is Commercial Real Estate”

Sunday, May 17, 2009

Miami Herald and FIU on Laundering Money via International Trade

My firm deals with many customers in the international trade business, importing and exporting. For those we do not know, we are sure to screen them as best we can before we do business. Some of my landlord clients demand this before they will execute lease agreements on their Miami warehouses. We are also asked to visit any prospective tenants current location to see their operation ensuring that is legitimate and active. Tenants are required to fill-out credit applications and are also screened via the US PATRIOT Act.

Wednesday, April 22, 2009

Miami Earth Day April 22nd, 2009

ComReal Miami commercial real estate is going green. Today is April 22nd, 2009 and we remind all of ourselves and our customers to recognize Earth Day in Miami. In recognition of Miami Earth Day, let's all remember today's meaning and reduce costs by doing the following around the office:

ComReal Miami commercial real estate is going green. Today is April 22nd, 2009 and we remind all of ourselves and our customers to recognize Earth Day in Miami. In recognition of Miami Earth Day, let's all remember today's meaning and reduce costs by doing the following around the office:* Keep lights turned off when not in use

* When printing: print in black instead of color; print on two sides; do not print extra pages if not necessary; recycle paper in stack (face up).

* Do not throw away paper clips, clamps, folders and binder inserts, comps, tab dividers, etc.

* Turn off your desk monitors, speakers, fans, etc. when not in use.

* The last person to leave should turn the A/C up to like 75 degrees.

Let us know if you have any other good tips.

Thank you!

Friday, March 13, 2009

Port of Miami Tour with ComReal and CIASF

March 13, 2009 - ComReal Miami commercial real estate sponsored the tour of the Port of Miami. The Commercial & Industrial Association of South Florida (CIASF) setup the event. Over 50 professionals showed up to listen to Bill Johnson, Director of Port of Miami, speak about various topics such as the Miami Tunnel, Miami cargo and freight, etc. The Port Tunnel is needed by 2018 since the deepening of the cargo harbor to 50' will be completed in 2014. This will be one of three seaports on the east coast of the United States that will be 50' deep. There are fourteen deepwater ports overall.

March 13, 2009 - ComReal Miami commercial real estate sponsored the tour of the Port of Miami. The Commercial & Industrial Association of South Florida (CIASF) setup the event. Over 50 professionals showed up to listen to Bill Johnson, Director of Port of Miami, speak about various topics such as the Miami Tunnel, Miami cargo and freight, etc. The Port Tunnel is needed by 2018 since the deepening of the cargo harbor to 50' will be completed in 2014. This will be one of three seaports on the east coast of the United States that will be 50' deep. There are fourteen deepwater ports overall.The Port's highest priority is safety and security. Miami and Jacksonville are the most secure ports in Florida. Both cities are fully compliant. A new cargo gate security facility has been completed. Security is important for the Port and Miami warehouses. Beacon 97, a Doral warehouse park, is 400,000 sq. ft. of high-security and full-time guard. Visit http://www.beacon97.com/.

Mr. Johnson is credited with lowering operating expenses and secured three contracts recently which will guaranteed $60M in revenue in 2008. Relationships have also been secured with Maersk and Seaboard Marine in Miami. China is Miami's leading trading partner. Followed by (in order): Honduras, Germany, Dominican Republic, Guatemala, Hong Kong, Jamaica, Panama, Italy and Colombia. Miami international real estate is at the center of global trade. Miami warehouses on rail will be be of greater importance such as this 127,000 sq. ft. building on FEC rail: http://www.miamiairportwarehouse.com/.

For more info, please contact ComReal Miami's industrial real estate division at 786-433-2379 or email: eredlich@comreal.com

ComReal Miami is also a proud Sponsor of the tour of the Miami Free Trade Zone in Doral on July 11th, 2009. Special Guest speaker is Neal Asbury of Greenfield Worldtrade Logistics.

A member from our Team will also be attending the Florida Cargo Brokers and Forwarders meeting on March 18th. The topic: Cargo Theft Briefing. Once again, Beacon 97 Business Park in Doral appears to be one of the safest Miami warehouse locations with it's high-security systems and full-time security guard. Visit http://http://www.Beacon97.com.

Monday, March 9, 2009

Miami warehouses on Twitter Miami

You can now follow Miami commercial real estate news on Miami warehouses by going to http://twitter.com/miamiwarehouses

This was my sister's idea since she is such a great web site designer. Check her website at http://www.thinkpinkwebdesigns.com/

Friday, March 6, 2009

Miami-Dade County Unemployment Rate goes down to 6.8%

In regards to Miami commercial real estate, we have seen activity increases significantly since the election and holiday periods. Some companies are doing quite well, however many are seeking exit and down-sizing strategies for both their Miami businesses and warehouses in Miami.

Monday, February 23, 2009

2009 SIOR Commercial Real Estate Index

SOCIETY OF INDUSTRIAL AND OFFICE REALTORS (SIOR) is known for it's exceptional market knowledge and capabilities of its members and the SIOR Commercial Real Estate Index. Ed Redlich, one of only 25 Miami SIOR's, has provided a summary of the results of the 4th Quarter 2008 survey below for the Miami industrial real estate market.

SOCIETY OF INDUSTRIAL AND OFFICE REALTORS (SIOR) is known for it's exceptional market knowledge and capabilities of its members and the SIOR Commercial Real Estate Index. Ed Redlich, one of only 25 Miami SIOR's, has provided a summary of the results of the 4th Quarter 2008 survey below for the Miami industrial real estate market.The Industrial Market Index, a miniscule 2.1 points higher than office, fell 15.4 points, its greatest quarter-to-quarter decline since the Index began in Third Quarter 2005, landing it at 43.6 points to end the year.

Respondents from the South, scored 54.2 points—the best score of all the regions—helped along by the East South Central and West South Central sub-regions which reported a score of 57.8 and 66 points scores respectively. Compared to other regions, vacancy rates in the South were closer to their Fourth Quarter 2007 level and respondents from the South reported stable prices.

Posted by

Edward Redlich

SIOR Miami

786-433-2379

eredlich@comreal.com

Friday, January 9, 2009

Miami Today article: Few ‘significant’ industrial real estate deals on horizon

BY MARILYN BOWDEN

Miami Today News

Long-term brokers in Miami Dade’s industrial market say several factors have converged to slow sales, and though inventory will probably grow they expect few large-scale transactions soon.

Setting market value is one challenge. While appraisals haven’t yet been a problem, said Ed Redlich, a vice president at ComReal, within a few months appraised values are going to drop.

“Appraisers look at pricing for a year back,” he said. “Since prices peaked about six months ago, we may see another 10%20% drop this year.” Even on deals under negotiation right now, he said, buyers’ expectations are changing rapidly.

“When property owners get an offer,” Mr. Redlich said, “they need to expeditiously negotiate it, because if it takes two to three weeks to get back to that proposal, the buyer may well say, ‘that was our proposal three weeks ago, but it’s not our offer anymore.’” Greg Zeifman, a senior associate in the Miami office of Marcus & Millichap, said sellers are not realistic in their pricing.

“I see listings priced more than twice what an investor would pay,” he said. “The fact is, most businesses are not doing so well today, but sellers want to believe that business owners are still out there wanting to buy assets, which is very rare.” Some companies will be forced to sell, said Mike Silver, first vice president at CB Richard Ellis. “We expect several large properties of more than 100,000 square feet will be placed on the market soon,” he said. “But due to cost containment in major corporations, we don’t see many significant industrial transactions going forward for the first half of 2009.” That’s partly because most of the larger industrial real estate investment trusts, or REITS, that in the past have been buyers are essentially out of the market due to financing issues, Mr. Silver said.

“Most of the institutions are pretty strong,” Mr. Zeifman said, “but they are not in the market to sell or to buy. They are in paralysis mode.

“They can’t get the funding they used to get and are not as bullish on the market, so they are in a holding pattern, operating their properties and retaining their tenants. They are pretty much on the sidelines as far as the industrial market is concerned and will be for another year.

Private equity players locally and nationally are buying distressed assets such as industrial condos, he said. “Most of these buyers are bottom feeders.” Mr. Zeifman said he’s heard that as lenders take back distressed properties, they are calling private equity firms and doing all-cash deals, “but that is happening under the radar screen.” But for users who can put money in, financing is available, Mr. Redlich said.

“Investors have to put larger amounts down. Investment properties have to have a cap rate of 8%-10%. It can’t be based on a projection of future property values,” he said. “Users can benefit by that more than investors. And while some users are in industries that are not doing well, some logistics and distribution, import-export, and food and beverage companies are so far doing fine.” Community banks and some other lenders are financing sales, Mr. Redlich said, “but they will take a hard look at the credit, and they want your bank account as well as doing your financing.” “If they’re going to make a loan, it will be for a maincorridor, type-A, property,” Mr. Zeifman said. “They’re not lining up to finance a multitenant facility with mom-andpops on month-to-month leases. It’s very rare that a lender would want to lend on class C assets.

“Most product in MiamiDade services small, entrepreneurial businesses on shortterm leases – tenants with no credit. These are not bankable deals.” Cash or seller financing will be the ideal ways to accomplish a sale in the coming months, Mr. Silver said.

“Though sales prices may not be what they were a years ago,” he said, “a lot of oppor tunities will be created due to current market situations, and there will be some deals made.”